Noen prosjekter

Vi tar gjerne en prat eller møte hvor vi kan ta med mange referanser.

Søkemotoroptimalisering

Søkemotoroptimalisering

Vi har over 10 års erfaring med SEO. Vi følger Googles retningslinjer og ser samtidig at kundene våre får flere og flere topp-plasseringer på Google!

Skal vi vise deg hvordan?

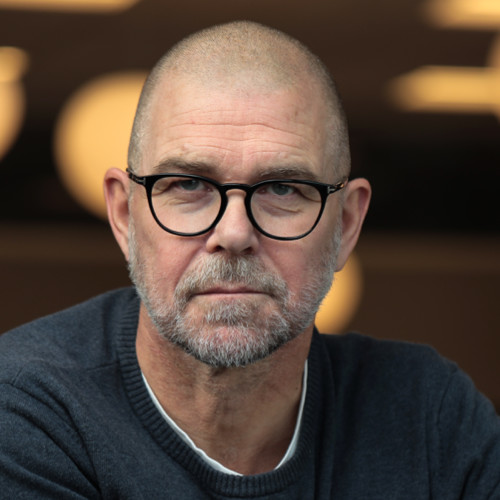

Ring Tommy på 975 28 712, så kan han vise deg.

ordet kan faktisk forkortes til SEO

Dette har noen av våre kunder sagt

Innsikt

I den digitale tidsalderen er det avgjørende for små og mellomstore bedrifter (SMB) å ha en solid digital vekststrategi.

Det nye navnet vårt, SalesUP, reflekterer tydeligere vår dedikasjon til å hjelpe våre kunder med å øke salget.

I den digitale tidsalderen er det avgjørende for små og mellomstore bedrifter (SMB) å ha en solid digital vekststrategi.